According to the website of the central bank, according to the statistics of the People’s Bank of China, at the end of the first quarter of 2022, the balance of RMB loans of financial institutions was 201.01 trillion yuan, up 11.4% year-on-year; In the first quarter, RMB loans increased by 8.34 trillion yuan, an increase of 663.6 billion yuan.

First, the loans of enterprises and institutions grew steadily, and the interest rate of new corporate loans was at a low level.

At the end of the first quarter of 2022, the loan balance of local and foreign currency enterprises and institutions was 129.83 trillion yuan, up 11.8% year-on-year, and the growth rate was 0.8 percentage points higher than the end of last year; In the first quarter, it increased by 7.25 trillion yuan, an increase of 1.69 trillion yuan.

In terms of terms, the balance of short-term loans and bill financing was 47.37 trillion yuan, up 11.5% year-on-year, and the growth rate was 5.3 percentage points higher than that at the end of last year. In the first quarter, it increased by 3.2 trillion yuan, an increase of 2.28 trillion yuan. The balance of medium and long-term loans was 79.14 trillion yuan, up 12.2% year-on-year, and the growth rate was 1.8 percentage points lower than the end of last year. It increased by 3.96 trillion yuan in the first quarter, a year-on-year decrease of 514.4 billion yuan.

In terms of purposes, the balance of fixed assets loans was 54.95 trillion yuan, a year-on-year increase of 9.5%, and the growth rate was 0.6 percentage points lower than that at the end of last year; The balance of operating loans was 52.73 trillion yuan, a year-on-year increase of 9.6%, and the growth rate was 0.2 percentage points lower than the end of last year.

In March, the interest rate of new corporate loans was 4.37%, which was 8 and 19 basis points lower than that at the beginning of the year and the same period of last year respectively.

Second, the growth rate of medium and long-term loans in industry is relatively high, and the growth rate of medium and long-term loans in infrastructure industry is stable.

At the end of the first quarter of 2022, the balance of medium-and long-term loans in local and foreign currency industries was 14.39 trillion yuan, up 20.7% year-on-year, and the growth rate was 9.7 percentage points higher than that of various loans and 1.9 percentage points lower than that at the end of last year. In the first quarter, it increased by 940.9 billion yuan, an increase of 24.9 billion yuan. Among them, the balance of medium and long-term loans for heavy industry was 12.32 trillion yuan, up 19.7% year-on-year, and the growth rate was 1.8 percentage points lower than that at the end of last year; The balance of medium and long-term loans for light industry was 2.07 trillion yuan, up 27.1% year-on-year, and the growth rate was 2 percentage points lower than that at the end of last year.

At the end of the first quarter of 2022, the balance of medium and long-term loans in local and foreign currency service industries was 52.22 trillion yuan, up 9.2% year-on-year, and the growth rate was 1.8 percentage points lower than that at the end of last year. It increased by 2.3 trillion yuan in the first quarter, a year-on-year decrease of 470.3 billion yuan. The balance of medium and long-term loans in the real estate industry decreased by 1.5% year-on-year, and the decline was 1 percentage point higher than the end of last year.

At the end of the first quarter of 2022, the balance of medium and long-term loans in local and foreign currency infrastructure was 30.26 trillion yuan, up 13.2% year-on-year, and the growth rate was 2.2 percentage points higher than that of various loans; It increased by 1.39 trillion yuan in the first quarter, a year-on-year decrease of 251.3 billion yuan.

3. Loans in inclusive finance maintained a relatively rapid growth rate, the proportion of credit loans increased, and the interest rate of new loans continued to decrease.

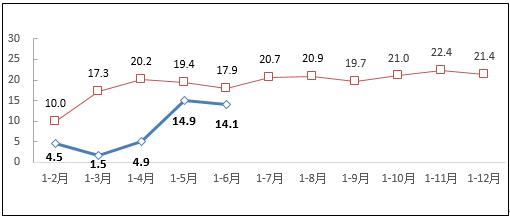

At the end of the first quarter of 2022, the balance of RMB loans in inclusive finance was 28.48 trillion yuan, a year-on-year increase of 21.4%, 1.8 percentage points lower than the end of the previous year; In the first quarter, it increased by 1.98 trillion yuan, an increase of 17.8 billion yuan.

At the end of the first quarter of 2022, the balance of Pratt & Whitney small and micro loans was 20.77 trillion yuan, a year-on-year increase of 24.6%, and the growth rate was 2.7 percentage points lower than that at the end of last year, of which credit loans accounted for 18.9%, 0.8 percentage points higher than that at the end of last year; It increased by 1.55 trillion yuan in the first quarter, a year-on-year decrease of 24.1 billion yuan. The balance of loans for farmers’ production and operation was 7.25 trillion yuan, a year-on-year increase of 14.1%; The balance of business guarantee loans was 251.3 billion yuan, up 11% year-on-year; The balance of student loans was 143.4 billion yuan, a year-on-year increase of 12.3%. In March, the interest rate of new loans for Pratt & Whitney small and micro enterprises was 4.93%, 17 basis points lower than that at the beginning of the year.

At the end of the first quarter of 2022, the balance of loans for people out of poverty nationwide was 953.7 billion yuan, up 16.5% year-on-year, and increased by 39.7 billion yuan in the first quarter.

Fourth, green loans maintained rapid growth.

At the end of the first quarter of 2022, the balance of green loans in local and foreign currencies was 18.07 trillion yuan, up 38.6% year-on-year, 5.6 percentage points higher than the end of last year, and 27.6 percentage points higher than the growth rate of various loans, with an increase of 2.05 trillion yuan in the first quarter. Among them, loans to projects with direct and indirect carbon emission reduction benefits were 7.79 and 4.22 trillion yuan respectively, accounting for 66.5% of the total green loans.

In terms of purposes, the loan balances of green upgrading industry of infrastructure, clean energy industry and energy conservation and environmental protection industry were 8.27, 4.74 and 2.32 trillion yuan respectively, up by 31.3%, 39.3% and 58% respectively. In terms of industries, the balance of green loans in electricity, heat, gas and water production and supply industries was 4.82 trillion yuan, up 29.2% year-on-year, and increased by 342.7 billion yuan in the first quarter; The balance of green loans in transportation, warehousing and postal services was 4.36 trillion yuan, up 13.2% year-on-year, and increased by 233.4 billion yuan in the first quarter.

V. The growth rate of agriculture-related loans remained stable.

At the end of the first quarter of 2022, the balance of agricultural loans in local and foreign currencies was 45.63 trillion yuan, up 12.2% year-on-year, and the growth rate was 1.3 percentage points higher than that at the end of last year. In the first quarter, it increased by 2.61 trillion yuan, an increase of 560.3 billion yuan.

At the end of the first quarter of 2022, the balance of rural loans (at or below the county level) was 38.13 trillion yuan, a year-on-year increase of 12.8%, and the growth rate was 0.7 percentage points higher than that at the end of last year; In the first quarter, it increased by 2.14 trillion yuan, an increase of 323.2 billion yuan. The balance of farmers’ loans was 14.05 trillion yuan, up 12.9% year-on-year, and the growth rate was 1.1 percentage points lower than the end of last year. It increased by 624.8 billion yuan in the first quarter, a year-on-year decrease of 30.9 billion yuan. The balance of agricultural loans was 4.84 trillion yuan, up 8.4% year-on-year, and the growth rate was 1.3 percentage points higher than that at the end of last year. In the first quarter, it increased by 280.3 billion yuan, an increase of 76.8 billion yuan.

Six, real estate development loans increased month-on-month, personal housing loan interest rates fell.

At the end of the first quarter of 2022, the balance of RMB real estate loans was 53.22 trillion yuan, a year-on-year increase of 6%, which was 1.9 percentage points lower than the growth rate at the end of last year; In the first quarter, it increased by 779 billion yuan, accounting for 9.3% of the increase of various loans in the same period, accounting for 9.8 percentage points lower than the level of the previous year.

At the end of the first quarter of 2022, the balance of real estate development loans was 12.56 trillion yuan, down 0.4 percentage points year-on-year, and the growth rate was 1.3 percentage points lower than that at the end of last year; The first quarter increased by 290 billion yuan, an increase of 441.4 billion yuan over the fourth quarter of last year. The balance of individual housing loans was 38.84 trillion yuan, up 8.9% year-on-year, and the growth rate was 2.3 percentage points lower than the end of last year. In March, the interest rate of new personal housing loans was 5.42%, 17 basis points lower than that at the beginning of the year.

Seven, the growth rate of household loans slowed down, and the interest rate of consumer loans dropped sharply.

At the end of the first quarter of 2022, the balance of household loans in local and foreign currencies was 72.37 trillion yuan, up 10.1% year-on-year, and the growth rate was 2.4 percentage points lower than that at the end of last year. In the first quarter, it increased by 1.26 trillion yuan, a year-on-year decrease of 1.3 trillion yuan.

At the end of the first quarter of 2022, the balance of operating loans of local and foreign currency households was 17.1 trillion yuan, up 16% year-on-year, 3.1 percentage points lower than the end of last year; In the first quarter, it increased by 888.7 billion yuan, a year-on-year decrease of 241.4 billion yuan. The balance of other consumer loans (excluding personal housing loans) was 16.42 trillion yuan, up 7.1% year-on-year, and the growth rate was 2.4 percentage points lower than that at the end of last year. It decreased by 150.2 billion yuan in the first quarter, a year-on-year decrease of 358.5 billion yuan. In March, the interest rate of new household other consumption loans was 7.68%, which was 67 and 41 basis points lower than that at the beginning of the year and the same period of last year respectively.