[car home Industry] On the first day of the new year in 2021, the news that the domestic Model Y went on the market at a reduced price exploded in an instant. The first thing that got caught up in the topic was (|), saying that since Model Y came out, many EC6 were unsubscribed. Li Bin and He Xiaopeng also voiced the price of Model Y successively, which probably meant "You have a good plan, I have a wall ladder".

Tesla has never been short of topics, and in China, it is the new forces that make cars that are most easily "caught up" by Tesla. In the Logo picture of the new car-making force that gathered all kinds of ambitions, only 10 cars were actually sold in 2020, and the cumulative sales volume of these 10 cars in the first 11 months was 121,087. In the same period, Tesla sold 121,969 vehicles in China, including 115,001 domestic Model 3 vehicles, accounting for 94.3%. "Barbarian" Tesla takes one as ten. How should the new forces continue to "fight"? How strong we are, we will give them a pulse with the amount of insurance that is infinitely close to the real consumption.

◆Which new power sells the most cars?

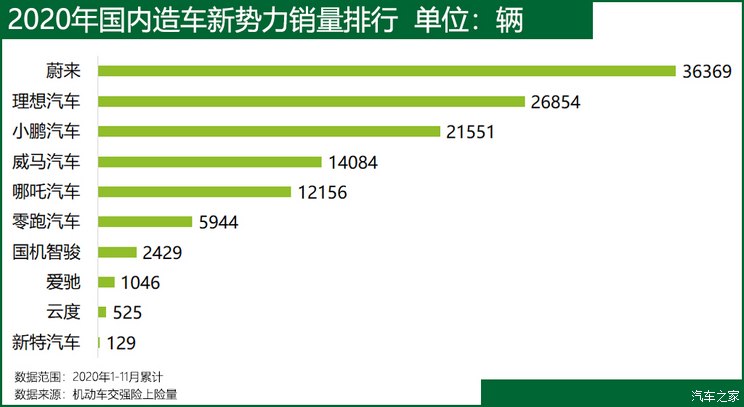

In 2020, the 10 new car-making forces with real sales volume are: Weilai, LI, Xpeng Motors, Weimar, Nezha, Zero Run, Guozhiwijun, Aichi, Yundu and Xinte. The actual market performance of these ten companies is uneven.

Judging from the total annual sales volume, Weilai is undoubtedly the best at present. According to the latest data, in the first eleven months of 2020, Weilai Automobile achieved a cumulative sales volume of 36,369 vehicles, ranking first among the new forces. According to the data released by Weilai itself, Weilai delivered a total of 43,728 vehicles in 2020, and the monthly sales in December was 7,007 vehicles. LI ranked second in total sales volume, with a cumulative sales volume of 26,854 vehicles in the first eleven months. LI was also the first car company to publish the sales volume of Shanghai Insurance as sales data, and its various meanings are self-evident. Xpeng Motors also sold more than 20,000 vehicles, ranking third in the new power list with a cumulative sales of 21,551 vehicles.

The above three new forces with annual sales of more than 20,000 vehicles are called "Li Weipeng". In 2020, the performance of "Li Weipeng" in the capital market is also "smiling", and the share prices of the three companies have all soared. As of November 28th, the cumulative increase in the coming year has reached 1243%, with Xpeng Motors rising by 328% and LI rising by 243%.

The annual sales of Weimar and Nezha cars exceeded 10,000, reaching 14,084 and 12,156 respectively. Behind Nezha’s cars are the new forces whose monthly sales volume is three digits or even two digits or single digits. Therefore, if 10,000 vehicles are used as the benchmark, five new forces will pass this threshold in 2020. "Li Weipeng" and Weimar and Nezha are called the "Top Five" of the new forces, and the "Top Five" is considered to have escaped from the new forces, but the pressure in the market outlook is still great.

◆ Which new car is the best seller?

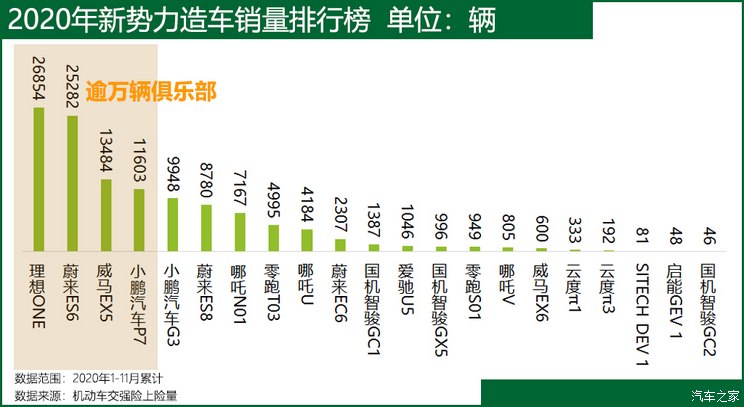

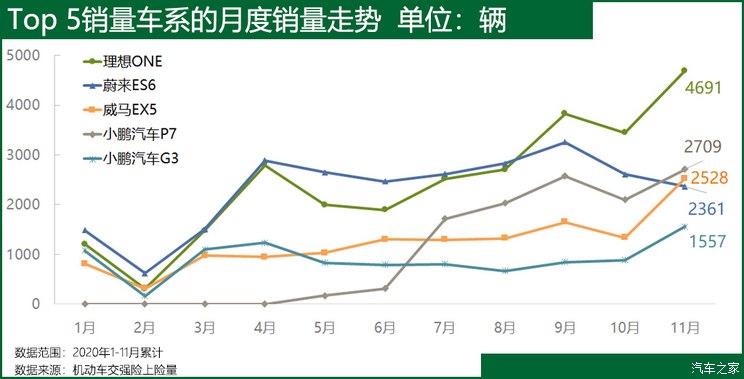

Speaking of bicycles, the best seller in 2020 is Li ONE, which is also the only Vivi in LI. In 2020, the monthly sales volume of Li ONE increased continuously, reaching 4,691 vehicles in November, and the sales volume in December is unknown, but the delivery data released by LI is 6,126 vehicles. Since September 2020, the sales volume of Li ONE has surpassed that of Weilai ES6, dominating the new force car list.

Weilai ES6 lags behind Li ONE by more than 1,000 vehicles, and these two vehicles are the only two with annual sales of more than 20,000 vehicles. The cars in the picture below are all the new energy vehicles sold by the new forces in the market at present, except Li ONE, all of which are pure electric vehicles. The picture also reveals a message: from the model level, medium-sized cars and SUVs above medium-sized ones are ahead (only Weimar EX5 is a compact SUV among the top five), while the sales of small cars and mini-cars are relatively behind.

LI is the only new force that doesn’t take the usual path-all the families take pure electric technology as their route, and their ideals are biased. Li Xiang recently said that LI will not launch pure electric vehicles until the 400kW fast charging technology is mature, and will devote itself to extending the range of power in the future, and plans to launch a new car every year after 2022, including an extended-range large SUV.

"Li ONE』"

In the first eleven months, the sales of four cars exceeded 10,000, namely Li ONE, Weilai ES6, Weimar EX5 and Tucki P7. Tucki P7 was put on the market in May 2020, so it is a bit of a disadvantage in the rankings. If we count from May, the sales volume of Tucki P7 in the same period has surpassed that of Weimar EX5. If we look at the twelve months of the whole year, it is expected that Tucki G3 will also enter more than 10,000 clubs, and Tucki G3 will have a good presence in the travel market.

"Tucki p7"

From the monthly sales trend of the five leading models, the trend of Li ONE is more stable, while Weilai ES6 has shown a downward trend since October. Is it because the listing of Weilai EC6 diverted some users? If this is the case, it is still a suspense whether Weilai EC6, which is directly impacted by the listing of Model Y, can take over Weilai ES6 in the future and play a supporting role in Weilai’s sales plate.

At the Weilai EC6 conference at the end of 2019, Li Bin, CEO of Weilai Automobile, once said: "In order to maintain the flexibility of some markets", the price of EC6 will not be announced first, after all, we have to wait for the first-class Model Y to release the domestic price. Now, Weilai EC6, which has a long-life guide price of more than 500,000, has been listed, but Model Y has unexpectedly dropped by about 150,000. EC6 was unsubscribed at the first time of online transmission. Although Weilai has come out to "refute rumors" and said that the price will continue to be firm against the standard BBA, there are still many requests for transfer orders in some forums. Let’s wait for the market outlook data that can really explain the problem.

"Weilai EC6』"

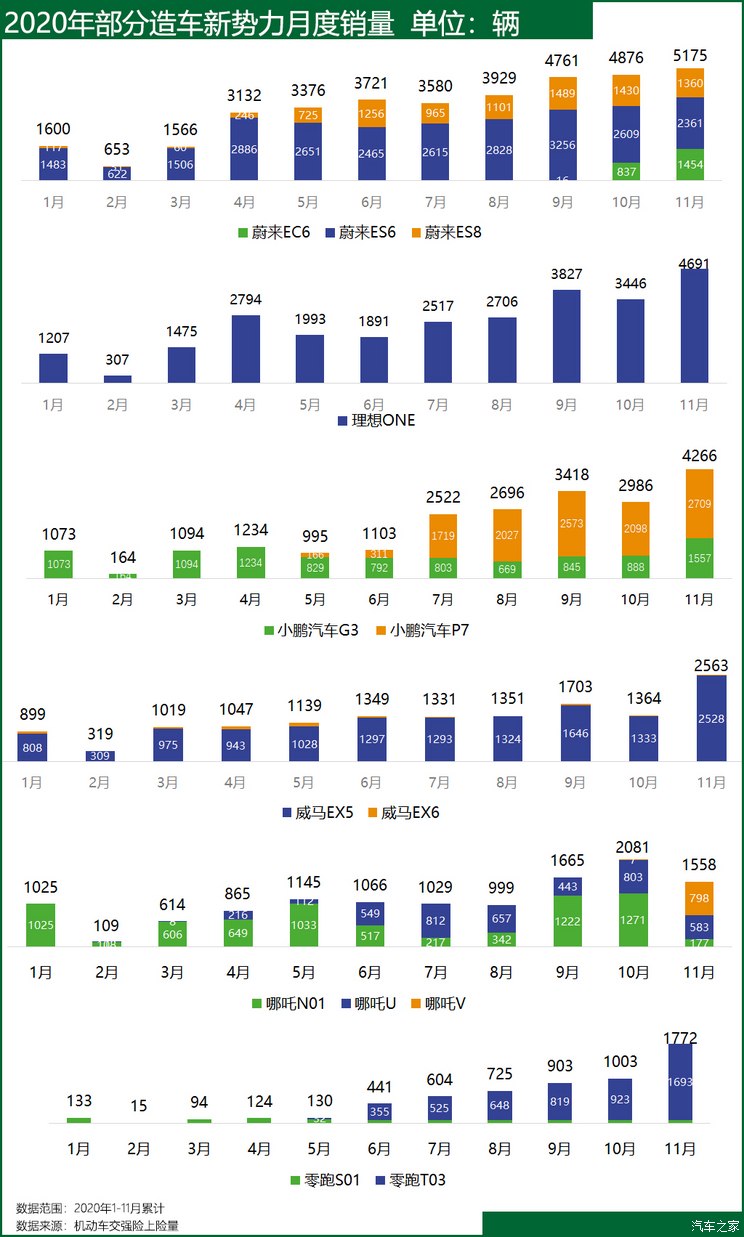

◆ Each inventory

Not much to say, let’s put a data map first. Among "Li Weipeng", Weilai’s product series is the most abundant. Weilai ES6 became the sales leader in 2020, but after the listing of EC6, the sales volume contracted, and the sales volume of EC6 reached 1,454 in the third month of listing, surpassing Weilai ES8. Weilai has also officially announced that its first flagship car will be officially released at NIO Day 2020, and its product line will be further enriched.

LI is the most maverick among the new forces. Li ONE went public in 2019, and it will be three years in 2021, and it is still its only product. It is reported that LI will launch a large SUV in 2022, and continue to use the extended powertrain. In an exposed product plan, in addition to the ideal X01, there are several models X02, S01 and S02, among which X02 and S01 are positioned as medium and large 6-seat SUVs, X02 is benchmarked against Mercedes-Benz GLE, and S01 is benchmarked against Model X;; S02 locates the medium-sized 5-seat SUV and targets Model Y..

Xpeng Motors’s two production and sales, Tucki P7 was once the pure electric vehicle with the longest cruising range on the market. At present, the monthly insurance sales volume is close to 3,000. According to information disclosure, Xpeng Motors will release a brand-new SUV in 2021, and its product positioning is higher than that of Tucki G3.

Let me talk about the second echelon. Weimar automobile was mass-produced earlier among the new forces, but it fell behind in 2020. The sales volume is mainly supported by Weimar EX5, and the sales volume of the newly launched Weimar EX6 is almost negligible. However, Weimar EX5 "burned four times in a month", which greatly reduced the reputation of EX5 users and cast a shadow over Weimar brand. However, from the monthly sales trend, Weimar EX5 still reached 2,528 vehicles in November, surpassing 2,000 monthly sales for the first time.

Weimar EX6』

Nezha automobile takes the micro route. In December, 2020, Nezha announced that it would complete the C-round financing with the final financing amount exceeding RMB 3 billion. After the completion of the C-round financing, it will go public in science and technology innovation board. Nezha Automobile has three models on sale, namely Nezha N01, Nezha V, which locates small SUVs, and Nezha U, which locates compact SUVs. Among them, Nezha V was only listed in early November 2020. Officials said that the order volume of the car in the first month of listing exceeded 5,000, and in fact, it sold 798 vehicles in that month, replacing Nezha 01 as the highest-selling model in that month.

"Nezha V"

Zero-run cars also started with mini-cars, and the zero-run T03 is the core model, which supports the brand’s annual sales. At the end of December, 2020, Zero Run announced the price of the third mass-produced model, Zero Run C11, and positioned the medium-sized SUV. The subsidized price was 159,800-199,800 yuan. Compared with the previous two models, Zero Run C11 is positioned in the more core and volume market of new energy vehicles in the future. At the same time, it is also on the same subdivision track as the head car companies, which is a big test for Zero Run.

"Zero run C11』"

In addition, only one model of Aichi is on sale, and the monthly sales volume of Aichi U5 remains within 200, with a maximum sales volume of 239 in September and a cumulative sales volume of 1,046 in the first eleven months. Guo Zhiwei Jun has three models on sale: GC1, GC2 and GX5. The cumulative sales volume of GC1 is the highest, with 1,387 vehicles, and the monthly sales volume is less than 300 vehicles. Followed by GX5, with a cumulative sales volume of 996 vehicles and a maximum monthly sales volume of 164 vehicles. The monthly sales of all models owned by Xinte Automobile and Yundu are single-digit and double-digit. For these two new forces, 2021 will be more and more difficult.

Editor’s comment:

Although it will take two weeks for the insurance data to be released in December, and the real 2020 report card is still one month short of data, the overall situation is set. Moreover, the listing of Model Y has exploded in the new energy automobile circle. How can Tesla, which is also under the banner of subverting traditional cars, hang a bunch of local new and old forces in the China market? Some people say that Tesla is a "science and technology religion", and leeks are cut one after another. But things are not so vicious and simple. When it comes to marketing, Weilai’s marketing and user service can also be called textbook level. What’s the difference with Tesla is that it refuses to cut prices? Do other new forces "put Tesla in the eye"? Even if you want to compete with Tesla, you need more consideration. Under the passion, you should pay more attention to the precipitation. 2021, bless the new forces! (Text/car home Wang Jingbo)