(Text/Zhang Zhifeng, Editor/Ma Yuanyuan) The official signing of the contract began, and Xu Jiayin successfully extended Evergrande’s life for three years in one move.

Less than two weeks after the disclosure of the overseas workout agreement, China Evergrande officially signed the agreement with creditors on April 3.

According to the core terms of the restructuring, Evergrande will issue new bonds to replace the original bonds; the new bonds will last for 4 to 12 years, with an annual interest rate of 2% to 7.5%; no interest will be paid for the first 3 years, and interest will be paid at the beginning of the fourth year, paying 0.5% of the principal.

It is worth noting that this does not mean that all foreign creditors support the restructuring plan.

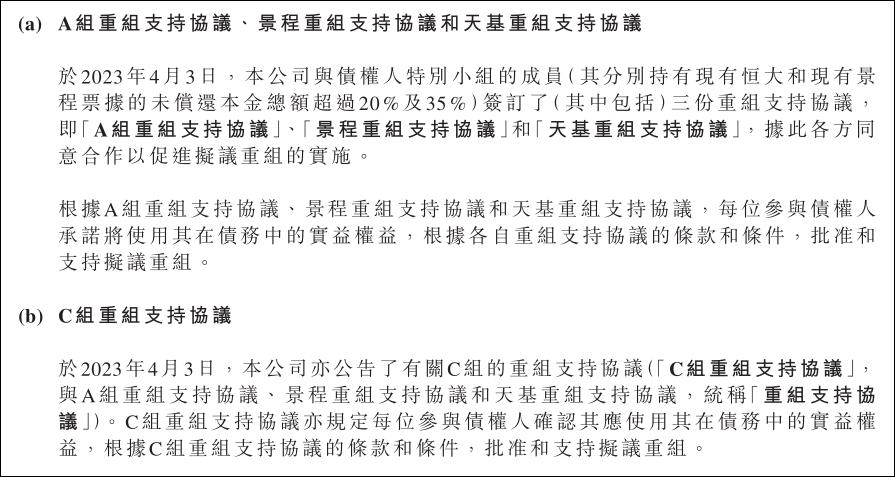

According to the announcement, the members of the special group of creditors who currently signed a restructuring support agreement with Evergrande hold only about 20% and 35% of the total outstanding principal of the existing Evergrande and existing Jingcheng Notes, respectively. The signed agreements are the Group A restructuring support agreement, the Jingcheng restructuring support agreement, and the space-based restructuring support agreement. According to this, the parties agree to cooperate to facilitate the implementation of the proposed restructuring.

Evergrande did not disclose the proportion of creditors who signed the Group C restructuring support agreement. At the same time, the company continued to invite all creditors to join in the announcement.

Evergrande said that it will fully invest in the protection of the building, stabilize the recovery momentum of sales, and gradually return to the right track.

However, this does not mean that Xu Jiayin can rest easy from now on.

According to the observer network previously reported that by the end of 2021, Hengda’s total assets 1.699 trillion yuan, but the total liabilities have reached 1.898 trillion yuan, that is, net assets are – 199 billion yuan.

In addition to the overseas debt that has been restructured this time, the domestic debt issue cannot be ignored.

The announcement shows that the overdue amount of Hengda’s domestic interest-bearing liabilities reached 208.40 billion yuan, the overdue amount of domestic commercial acceptance bills reached 326.30 billion yuan, and the overdue amount of domestic contingent debts reached about 157.30 billion yuan.

As of the end of 2021, the company’s domestic overdue debt totaled 692 billion yuan, and more than half of the domestic creditors have taken legal action.

Evergrande said that its core task for the next three years is to "protect the building" and will strive to maintain the "resumption of work and production" to maintain orderly operations. It is expected that an additional 250 billion yuan to 300 billion yuan of financing will be required.

From the fourth year onward, assuming that the company can resume normal operations and that the old reform projects that have not yet been confirmed as the main implementation entities can continue to be developed, the unleveraged free cash flow is expected to increase gradually.

Evergrande expects to achieve unleveraged free cash flow of about 110 billion yuan to 150 billion yuan annually from 2026 to 2036.

This article is an exclusive manuscript of Observer Network and may not be reproduced without authorization.